AI is rapidly transforming digital commerce, moving beyond back-end operations to directly influence how consumers interact with brands. This evolution, marked by the rise of agentic AI, offers immense opportunities for frictionless purchasing and enhanced customer loyalty.

However, it also ushers in a new era of risk, particularly in the realm of abuse. Understanding these emerging “abuser archetypes” and adapting fraud prevention strategies is paramount to protecting revenue and preserving the customer experience.

The Rise of Agentic Abuse?

Agentic AI refers to intelligent systems designed to initiate, plan, and execute tasks autonomously, often on behalf of a human user. These agents are not merely tools; they are decision-makers capable of comparing prices, initiating checkouts, and even triggering returns — without direct human input.

While this promises unprecedented efficiency for legitimate customers, it also empowers bad actors to automate and scale abusive behaviors in ways previously impossible.

- The Coupon Stacking Bot Army: AI agents may be deployed en masse to find and exploit promotional codes, gift-with-purchase offers, and loyalty program sign-up incentives, combining offers in ways unintended by merchants. These “bot armies” could quickly deplete marketing budgets and erode margins by systematically leveraging discounts across numerous accounts. This tactic manipulates automated systems, directly impacting profitability.

- The Scaled Reseller: Historically, resellers might manually track limited-drop items or concert tickets, often employing simple bots. Now, agentic AI can monitor availability across multiple platforms, execute rapid-fire purchases, and even manage inventory and re-listing, all with minimal human oversight. This allows for the rapid acquisition of high-demand goods, often leaving legitimate customers unable to purchase and frustrating the customer experience.

These new archetypes highlight a critical challenge: distinguishing between a legitimate customer using an AI assistant for convenience and a sophisticated fraud ring deploying AI agents for systematic abuse.

The Limitations of Traditional Fraud Controls

Traditional fraud models, often built on rigid rules and historical patterns, are ill-equipped to combat these new forms of agentic abuse. They struggle to adapt to the dynamic and machine-driven nature of AI-powered interactions. Attempting to “catch” these new abusers with old methods can lead to:

- Increased False Declines: When fraud controls rely on static parameters instead of dynamic, data-driven insights, legitimate transactions get caught in the net. This frustrates customers and directly impacts revenue, as most customers won’t try again, taking their business elsewhere.

- Loss of Visibility: As interactions become faster, machine-driven, and opaque, solutions are unable to surface insights in the first place. The insights are buried in transactions that seem disparate because legacy solutions aren’t able to connect the dots the way identity intelligence can (via linking, etc.), which leaves merchants to use manual efforts, cumbersome spreadsheets, and disparate systems to try and identify abuse.

- Eroding Customer Lifetime Value (CLTV): False declines and friction in the checkout process directly impact customer satisfaction and CLTV. In an AI-driven economy where efficiency and personalization are key, a seamless experience is crucial.

Building Trust in an AI-First Era

The solution lies in building trust not just with human consumers but with the intelligent systems acting on their behalf. This requires a foundational shift in how businesses approach fraud and abuse*, moving towards a system rooted in real-time identity intelligence.

To effectively combat agentic abuse and maintain a superior customer experience, commerce systems must be able to:

- Recognize and Validate AI-Driven Transactions: It’s crucial to identify legitimate AI activity from good customers without introducing friction into the checkout flow. This means understanding the provenance, intent, and delegation authority of the agent.

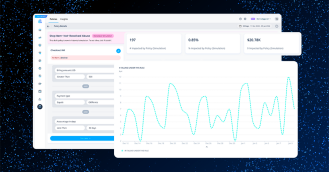

- Distinguish Good Agents from Bad Bots: Leveraging machine learning and a comprehensive identity graph can help differentiate between benign automated behavior from good customers and legitimate resellers and malicious bot activity. This dynamic approach allows for real-time adaptation to evolving fraud patterns.

- Adapt to New Patterns of Behavior: AI agents will continuously learn and evolve, and fraud trends are not stagnant. Your fraud and abuse prevention solution must be equally adaptable, utilizing continuous data insights to stay ahead of emerging abuse tactics and surface-shifting behavior from bad actors as it occurs.

- Provide Explainable Decisions: As AI automates more of the customer lifecycle, businesses need reliable self-serve tools and clear visibility into AI actions. Explainable AI decisions can help reduce false positives and provide valuable insights for internal stakeholders, ultimately enhancing the overall effectiveness of AI-driven systems.

By investing in a solution that combines advanced machine learning with a deep understanding of identity, businesses can protect themselves from the new abuser archetypes.

This isn’t just about stopping bad actors; it’s about enabling legitimate customers to leverage the benefits of agentic AI, unlocking loyalty, speed, and efficiency at a scale only possible in an AI-driven economy. The right fraud prevention strategy enables trust to be earned, measured, and enforced in real time rather than merely assumed.