Forter COO Colin Sims and Forter Senior Analytics Team Lead Nir Maayan recently sat down with Mike McCormack, Vice President of BWGConnect to discuss how Coronavirus (COVID-19) has impacted global e-commerce and fraud trends across industries.

During this session Colin and Nir discussed:

-

- Macros trends in global e-commerce

- Shifts in merchants’ approach to their business operations

- Shifting consumer behaviors as a result of COVID-19

- Shifts in fraud and abuse across industries including:

- Travel

- Fashion & Beauty

- Food & Beverage

- Marketplaces

- Digital Goods

To begin the discussion, Colin presented Forter’s position in the market, and some of the macro-level impacts the company has witnessed throughout the early days of the COVID-19 outbreak.

Forter holds a unique place in the global commerce market as an intermediary sharing insights across a network of enterprise merchants which captures data from more than 620 million consumers.. Forter leverages this data – including touch points ranging from new account interactions, to loyalty programs, and returns abuse – in conjunction with human expertise and industry knowledge to help customers process online transactions accurately and as quickly as possible while protecting themselves from fraud and abuse.

Macro Trends Across the Global Market

As the impacts of COVID-19 continue to unfold, it is important to note that the data Forter traces are contained to digital or online channels. While Forter may see volumes for some online apparel merchants positively trending, it is important to understand that this does not necessarily coincide with their results in the physical world, where many businesses have been forced to shutter their stores.

As such, the world is currently divided into the “have” and “have nots,” comments Sims. Some industries have benefited significantly from the current conditions, i.e. grocery and on-demand delivery services or marketplaces for liquor, laundry, or restaurants. While industries including travel brokers or event coordinators have experienced dramatic downturns in transaction volume. For example, the travel industry has declined by nearly 80-100% in volume while events merchants’ transaction volumes have been nearly negligible during this period.

Given the variations in consumer behaviors and trends in what people need during the current climate, it is not possible to paint the global e-commerce landscape in broad strokes. There are nuances across industries and even within particular categories of stores and products that must be taken into account.

Consumer Trends and Fraud Behaviors

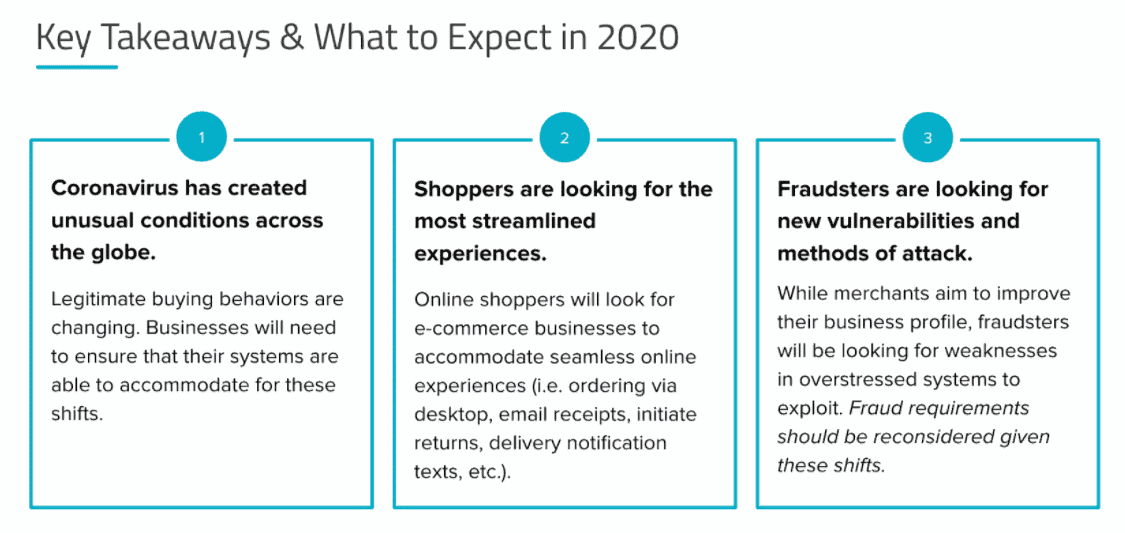

As one of the leading analysts at Forter, Nir outlined the importance of understanding three different areas as we look at trends across e-commerce industries.

- The merchant approach

- Consumer buying behaviors

- Shifts in fraud

These three factors create somewhat of a never-ending chain reaction. As consumers change their behaviors and buying habits, merchants thereby shift their approach to daily operations and adapt their portfolios, while fraudsters then likewise shift and adapt their behaviors as well. These three factors are always in relationship with one another and they are important to keep in mind as we look across different industries and try to understand why different phenomena or trends occur.

Industries

With people across the globe suddenly finding themselves without brick and mortar stores to visit, there has been a natural increase in online activity. People – both those that have been habitual online shoppers, as well as those new to online shopping altogether – now have a sudden need to buy both essential and non-essential items from online merchants.

Here are some of the trends Forter has recently seen across the following industries:

Fashion & Beauty

- Changing Merchant Policies

- Contactless shipping has now become a growing trend as people try to limit their physical exposure to delivery workers

- Returns, refunds, etc., are requiring a more hands-on and active approach from merchants.

- Promotions

- Many apparel and beauty brands are running very large scale promotions in recent weeks in order to further entice consumers to their sites. However, this can also lead to increases in promotional abuse and merchants will need to be aware and prepare their businesses for this shift in behavior.

- Increase in (new and active) online shoppers

- Increase (and decrease) in demand of specific items. For instance, apparel merchants are seeing more sales of pajamas and activewear.

Travel

- Increase in last minute bookings

- There has been an increase in Customer Support/Service workloads

- With more travelers cancelling or changing their travel plans due to travel restrictions, CS teams have been bombarded with more requests than ever before. Merchants need systems that are able to respond nimbly to these requests in order to ensure that customer experience is not negatively impacted during this period.

- Increase in chargebacks

- Shift in fraud to other channels

- Fraud is expected to shift to channels that do not require reselling of goods. Loyalty fraud is an area that is therefore likely to be impacted.

Digital Goods

- Overall increase in new accounts

- Gift Cards

- Gift cards have seen an increase in volumes and they provide an easy target for fraud as they are anonymous and very easy to monetize.

- Gaming has seen an increase in virtual interactions and virtual coin purchases

Marketplaces

- Increases in sellers offering popular items

- Increase in scams

- There have been sellers overpricing items, knowing that the demand for specific products is higher than usual

- Fake seller profiles selling fake goods or never delivering items ordered

- Increase in purchase volume of essential goods (and even magic spells for good health)

Food & Beverage

- 150% increase in consumer volume, especially in new accounts

- Service CBs and friendly fraud (returns)

- Contactless shipping increase given consumers desire to avoid physical contact

- Increase in the average order value (AOV) for carts

- Increase in the purchase of groceries in general but also specifically canned food, toothpaste, and toilet pape

Projections for the Coming Months

For more details on consumer trends across industries, the impacts of COVID-19, and how to better prepare your business in the coming months, listen to the full recording or read our Special Report here.