Payments teams put tremendous thought into perfecting the checkout process for customers — often emphasizing the later stage of a transaction’s journey. But there’s a crucial stage in the middle, once a processor or PSP has sent the transaction to the issuing bank and before the bank sends its response. This is the stage of authorization.

Historically, payments teams have assumed that there was no real way that they could influence bank authorization. However, that’s no longer the case due to a combination of new technologies and a renewed focus from banks on improving network engagement. Payments teams can improve their bank authorization rate — and pick up a substantial revenue boost.

What Really Happens During Bank Authorization & Why It Matters to Merchants

Bank authorization processes check some important things, like whether the account exists, whether it has enough money for the transaction, whether the expiration date given is accurate, if the billing address matches what’s on file at the bank, etc. Payment processors offer add-on services to handle declines associated with these issues through products such as network tokens and account updates.

Due to a lack of communication between banks and merchants, and the value-adding services offered by processors that cluster around these areas, payments professionals often assume that this is all that bank authorization is for.

In reality, bank authorization processes also include a fraud check, during which the bank needs to make its fraud decision based on very little data. They only get the basic details sent with the transaction (amount, merchant name, timestamp, first five card details, etc.). No behavioral information, browser information, device fingerprinting, IP address, site account history, cart details, and so on.

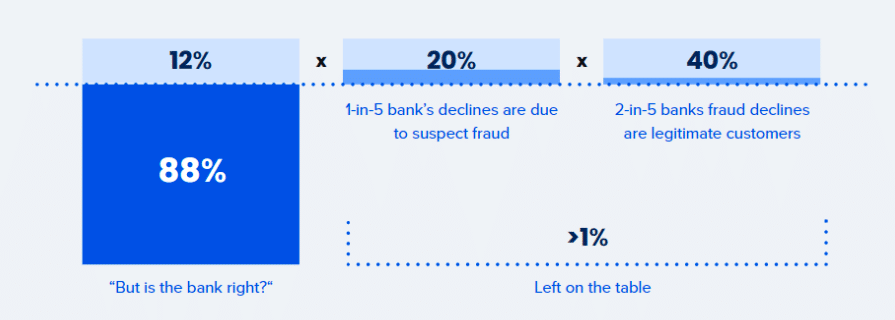

Inevitably, making fraud decisions on minimal data leads to false positives. About 1-in-5 bank declines are due to suspected fraud. Of those, 2-in-5 bank fraud declines are legitimate customers. That’s a lot of money merchants never get to see — and usually don’t even realize they’re missing out.

Why You’re Not Approving As Many Transactions as You Think

All this means that merchants often don’t understand their true approval rate accurately. However good a merchant’s internal approval rate is, transactions that the bank declines are simply lost revenue. A significant percentage of that lost revenue ought to have been approved.

Example: Looking at a Real Approval Rate

ACME, an online merchant, has an internal approval rate of 98%. Their fraud prevention team is excellent, the whole company is aligned around optimizing the customer experience and revenue, and they’re confident in their approval processes.

ACME’s bank authorization rate, however, is 88%. Considering the bank’s false declines, ACME’s real approval rate is only 86.2%. That leaves 1% of their total transactions on the table, lost for all the wrong reasons.

This example shows the impact on revenue that changing the dynamic with bank authorization can have. There’s the potential for reclaiming a considerable amount of money.

All of this is true for merchants from every industry. Merchants from industries considered high-risk, such as digital goods, may see even higher levels of uplift because their authorization rates are often lower due to the greater risk of their vertical.

How to Reclaim Those Lost Transactions

Bank authorization processes reject transactions mistakenly because they don’t have enough information to make more accurate decisions. So the solution is to give issuing banks a reason to approve instead of decline.

Many merchants currently carry out their fraud analysis of transactions post-authorization. Shifting the fraud decision process to pre-authorization means merchants can send additional relevant information to the bank along with the transaction so that the bank can trust that the transaction is good and should be approved. Beyond that, “cleaning” the transactions so that only good ones are sent to the bank in the first place gives the bank greater reason to trust the merchant, which over time can lead to merchants experiencing overall lifts in authorizations.

While banks used to be relatively uninterested in investing in this kind of deeper communication with merchants, they are now actively focusing on increasing network engagement and encouraging this kind of interaction.

Merchants who are willing to either invest in the relationships with different banks directly or leverage the existing trusting relationships of partners have several options available for sharing trust with banks. Through these, they can reclaim the transactions that would otherwise be lost — and turn false declines into conversion uplift. These include:

- Sharing relevant information about the user and transaction with the bank

- Sharing fraud decisions and trust in users

- Issuer optimization

- Using 3DS in a way that’s tailored to both customer and bank

- Leveraging PSD2 in Europe to maximize the benefit for the business

- And more.

But it all starts with treating banks as partners.

The Impact on Conversions

As well as the revenue uplift from reclaiming transactions that would otherwise be lost, it’s important not to lose sight of the improvement in customer experience that also comes from avoiding unnecessary false declines. There’s no worse customer experience than a mistaken rejection.

Good experiences, on the other hand, make it more likely that users will return and become loyal customers. Each business calculates its customer LTV slightly differently, but the impact on growth and profitability is significant. This longer-term perspective is also worth bearing in mind when considering the complex reality of approval rates, especially as it relates to bank authorization.

To read more about the challenges of false declines at the point of bank authorization, and the approaches that merchants today are taking to solve them, read this white paper: Payment Optimization: Surfacing Simple Decisions to Unlock Millions in Revenue (& Improve Customer Experience).