Fighting fraud is a constant battle. Knowing as much about the opponents as possible is key to making sure that they never get ahead. At Forter, we’re constantly analyzing our data to reveal new insights about the challenges fraud prevention faces, and pick out trends that can be useful in combating them.

Recently we took a look at what timing can tell us about how fraudsters like to work. Here’s what we learned.

Fraudsters are Night Owls

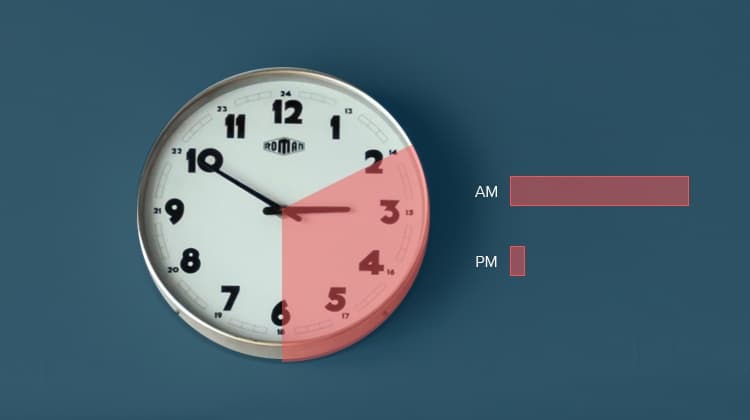

It turns out that the rate of online fraud goes up significantly at night. Specifically, the rate of fraud between 2am and 6am is ten times as high as the rate between 2pm and 6pm.

That’s… pretty huge. Why this massive difference?

There are a few things to bear in mind in understanding why this is the case.

- We’re talking about rate, not overall amount. Naturally, there are fewer legitimate shoppers at this time of night, so the fraudsters stick out more, so to speak. There are fewer genuine shoppers to balance them out. So why don’t fraudsters shop like other people?

- That leads us to the second reason. Stealing goods online and cheating merchants out of their hard-earned money is much easier (and safer) when you’re concentrating on it. That means that for fraudsters who have a day job, their online thievery is likely to happen at night, because that’s when they have time for it.

- Plus, thirdly, time difference is an important factor here. You have to remember that crooks stealing from US retailers aren’t necessarily based in N. America themselves. Night time in the States might well be bright daylight wherever the fraudster is based.

Fraudsters Don’t Take Time Off

The rate of fraud absolutely skyrocketed over Christmas Eve and Christmas, going up by an astonishing 200%.

If you were paying attention above, you’ll realize that that’s partly because, as in the early hours of the morning, there simply aren’t that many real customers shopping online during that time. By Christmas Eve, it’s too late to purchase last-minute gifts online; if you’re that late with your present-buying, you’ll need to join the crush in the physical stores and hope they’ve got what you need. And most people are too busy stuffing themselves with turkey to bother shopping on Christmas itself!

So why aren’t fraudsters affected by these same considerations?

Well, while it does happen that a criminal will use someone else’s credit card to buy things for themselves or as gifts for those they’re close to, this is by no means the most common kind of theft. You can’t think of a fraudster as an overgrown teenager who ‘borrows’ the parental card to get that new game or fashion accessory. These are professional criminals, and they act like it.

That means that they like high value items, and more particularly they like items it’s easy to resell, ideally for as close to what they ‘paid’ for it as possible. They’re not affected by the Christmas rush because they’re not buying things for Christmas. They’re buying objects they’ll fence the next day, the next week, the next minute. It’s their business – even though it’s your money.

Why Should Merchants Care?

If you’re a retailer who still performs manual reviews – and 81% of online retailers do – then you’ll want to bear this data in mind.

It’s unlikely your manual review team works in shifts around the clock, and nor is it likely that they work on national holidays. They’re people, after all! But that means that, although it is extremely tempting for reviewers to rush through the pile of transactions awaiting them in the morning, and the even larger pile that mounts up during the holidays, they can’t afford to hurry. In fact, as we’ve seen, those are precisely the times when they have to be more careful than usual.

If you don’t use manual reviews, and are fully automated like Forter, then congratulations, this problem won’t be as severe for you. But information about when fraudsters generally operate (and an insight into why that’s the case) is valuable for anyone who cares about preventing fraud, and the losses it represents. Take it into account next time you’re assessing your own review system and how it works.

To find out more about how fraudsters operate, check out the article on Retail Online Integration.