How Abiding by PSD2 Regulations Can Improve Sales & Conversion

It is always advisable to follow the rules, particularly for businesses and organizations. Beyond the risk of fines, when companies do not follow the rules, they may suffer reputational damage and losses that may be more harmful to their operations in the long run.

Sometimes, however, playing by the rules can even help win the game. Such is the case with the Revised Payment Services Directive (PSD2).

The PSD2 directive goes into effect on December 31, 2020, forcing all online payments within the European Union (EU) and European Economic Area (EEA) to process payments using the new Strong Customer Authentication (SCA) method. While complying with the regulations will ensure that businesses do not incur fines, if done the right way, it can actually help organizations increase revenue, reduce e-commerce fraud risk, increase transaction approval, and minimize risk liability.

The Fear of Friction

PSD2 creates many challenges for merchants looking to comply with it. Ironically, the least of their concerns is actual compliance. Merchants are increasingly concerned with optimizing sales and improving the checkout process, and the new PSD2 regulations severely impact that ability.

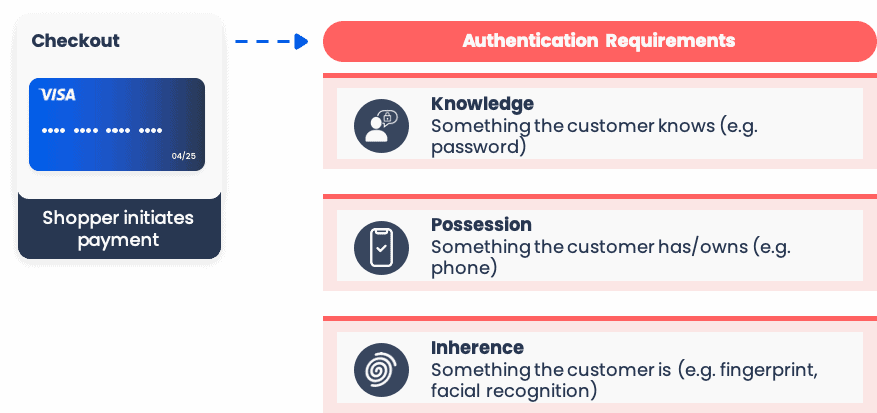

PSD2 requires the use of two out of three independent authentication elements to verify payments. These additional verification steps increase the friction that consumers experience, reducing conversion, and leading to business losses.

It is possible to request SCA exemption, particularly for low-risk transactions. However, to grant this exemption, acquiring banks will need to minimize their portfolio fraud rate.

How Acquiring Banks Minimize Portfolio Fraud Rate:

- Place the same rules on all of their merchants

- Require all of a merchant’s transactions to undergo 3DS authentication

- Reduce overall portfolio risk

Why is this a problem? While this increases overall security for the acquiring bank, it negatively impacts the conversion ratio of merchants.

Forcing all transactions to go through 3DS will result in more legitimate transactions being rejected and even higher checkout abandonment rates.

Higher Abandonment = Lower Bottom-Line Profitability

Today, up to 30% of 3DS transactions are lost throughout the checkout process due to user drop off and abandonment, 3DS challenge failure, and decline due to issuer fear of liability shift. However, with the new PSD2 regulations, security measures will have to increase, further risking profitability.

So how can businesses comply with PSD2 without sacrificing conversions?

Reduced Friction Transactions with Dynamic 3DS

While the PSD2 directive may add steps to the checkout process and potentially increase friction, businesses with smart payment protection and optimization solutions can benefit from increased security, reduced risk, and increased transaction approval.

A smart payment protection and optimization solution will ensure PSD2 compliance while providing additional benefits that increase conversion and profitability for merchants.

Customized Purchasing Journey

One of the ways to reduce friction and increase conversion is by integrating dynamic 3DS. With dynamic 3DS, the consumers’ payment is routed according to their individual user profile and purchasing patterns, creating a customized purchasing journey for each consumer. As a result, there is a reduction in verification friction, and the chances of the consumer completing checkout increases.

Pre-Authorization Fraud Prevention

In addition to customizing the purchasing journey, merchants can increase conversion by having pre-authorization fraud prevention. If integrated as part of the dynamic 3DS solution, the transaction approval ratio will increase by an additional 3-5%.

The most important way to avoid 3DS under PSD2 is to ask for TRA exemption (transaction risk assessment). By doing this, the merchant declares that the transaction is low risk, and therefore would like to avoid 3DS. Exemptions must be approved by both the acquirer and the issuer in order to be successful. While every merchant can request an exemption, only merchants with very low fraud rates will be approved.

Many acquiring and issuing banks are wary of taking on the risk. However, with a payment optimization solution that also includes eCommerce fraud protection, that risk is eliminated.

Consider the Entire Ecosystem

To understand how to maximize conversion while retaining PSD2 compliance requires taking the entire payment ecosystem into consideration. The way to do this is through the integration of dynamic 3DS. With dynamic 3DS it is possible to route each consumer to the authentication element most likely to reduce friction and drive completion, all while considering their unique risk level. This, alongside pre-authorization fraud decisions, can further increase a merchants’ transaction approval ratio by an additional 1-3%.

Recovering Legitimate Declines

If a legitimate transaction is declined, a payment optimization solution can recover 10-15% of declines, further increasing approval by 1%. Decline recovery is completed without the consumer knowing of it, reducing the likelihood of abandonment and increasing profits. Overall, the integration of dynamic 3DS for PSD2 can improve customer experience, reduce friction, and increase merchant revenues by up to 10% – a clear win for merchants.

To Win the Game, Choose a Winning Partner

Businesses and organizations that want to play by the rules and still win the game need to choose a winning partner with a payment optimization solution that meets their needs.

The right payment optimization partner will be able to provide merchants with advanced e-commerce fraud detection, Dynamic 3DS, Exemptions Engine, and a Decline Recovery mechanism.

Forter’s payment optimization solution is a game-changer for merchants required to meet the PSD2 directive without sacrificing conversions. Businesses outside of the EU may also want to adopt Dynamic 3DS to stay ahead of the regulatory trend and provide their customers with a better purchasing process in a more secure way.

The Forter Dynamic 3DS for PSD2 solution offers multiple advantages designed to reduce friction, increase approval, and ease of purchase, all while ensuring full e-commerce fraud protection, making Forter the winning partner for your business.

Subscribe to Forter’s fortnightly newsletter to receive updates on PSD2 insights and strategies.