The spread of Coronavirus (COVID-19) has completely changed the manner by which people in every country are able to live their lives. As individuals around the world begin to shelter in place in many locations, what does this mean for global commerce trends and how is fraud changing during this period? Each week, Forter will report on the latest e-commerce and consumer trends across a number of industries as well as point to some of the shifts in methods of fraud attacks that we are seeing.

*Data current as of March 22*

FOOD, BEVERAGE, AND DELIVERY SERVICES

While many other industries are dealing with sudden dips in overall volume, businesses related to this category are instead witnessing a significant increase in volume and overall order value. The importance of food, beverage, and delivery services has never been more acute. As restrictions on outdoor excursions grow more stringent, people around the world are in need of a means by which to get food to their homes while limiting their interactions with other individuals. These categories have seen an overall increase in volume (including pickup of orders), an increase in specific goods (groceries), as well as a trend of larger than usual carts / or higher total cart value.

150+% Forter data indicates a large increase in overall traffic to businesses within this industry.

150+% Forter data shows that more and more clients are buying and stocking up on groceries via online grocery platforms.

20+% Due to people purchasing more per each time they shop, the average order value (AOV) is climbing.

BEAUTY

As more and more people are being relegated to quarantine, the beauty industry has seen an uptick in consumer buying activity.

Forter data indicates that beauty and skincare businesses are seeing between 50-100% increases in overall volume.

As more people are home with time to fill, order volume in this industry is increasing. This may be attributed to the desire for individuals to advance their skincare and beauty routines, or try products that they may not have had ample time to test before.

APPAREL AND ACCESSORIES

It is still early days as non-essential retailers are being forced to close their doors, so data in this category is still being accumulated. That being said, the immediate impacts of Coronavirus are being felt within this industry.

Forter data indicates up to a 30% decrease in physical goods in some geographies for businesses related to the apparel and accessories industry.

Forter data indicates an increase in certain types of physical goods within this category. For instance, shoes and footwear are becoming more popular items among consumers. Retailers holding sales during this period are seeing the power of these promotional periods in attracting buyers. Some apparel and accessories merchants are seeing nearly 3x the normal rate of transactions due to their promos during this time.

Apparel and Accessories Fraud Trends to Watch

Within this category, merchants should be aware of:

- Contactless Shipping and Delivery as a potential avenue for fraud. This is when physical goods are delivered to shoppers’ specified address, but there is no interaction between individuals in order to minimize the potential for exposure. Merchants in this category should also prepare for an increase in Buy Online Pickup In Store (BOPIS) as a potential segment to monitor for friendly fraud. Friendly fraud related to BOPIS is likely to occur as purchases made prior to movement restrictions may bring about the inability for customers to actually pickup their orders both because they cannot get to the store and because the store may be closed. Additionally, if shoppers pick something up at the store and then wish to return it, they will be limited for the reasons detailed above.

Merchants should proactively address the issues surrounding Corona and the virus’ potential impact on their business and their policies (including returns policies and promo/coupon policies). By preemptively addressing the impacts of the virus on changes to business practices or policies, it is likely that merchants will face less friendly fraud (where good customers aim to take advantage of merchant’s policies for their own gain) and incidences of abuse.

- Promo Abuse: Promo abuse occurs when legitimate customers or fraudsters create new/multiple accounts to receive one-time use promotional codes that they use multiple times, or when shoppers overshare coupon codes in refer-a-friend activities. As merchants aim to draw in more customers during this time, there has been an increase in the offering of promotions or discount codes in order to further entice consumers to their brands. Merchants must ensure that they have proper fraud and abuse protections in place in order to combat a likely significant uptick in promo-related abuse.

TRAVEL

In spite of the overall decline in travel that we’ve reported previously, we do see short-term regional spikes in activity. We have seen this associated with the impact of Coronavirus as it has spread to more countries, with travelers hurriedly leaving the countries before travel restrictions apply.

200+% Spike in Regional Demand – Forter data shows that massive spikes in regional activities have occurred as a result of the global pandemic.

150% Increase in Last Minute Bookings – In some instances, travel companies may equate last minute travel bookings or arrangements as tell-tale signs of fraudulent activity and block it. However, legitimate customers are also booking last minute, especially in light of current global events and the imposition of travel restrictions being put into place. Forter data shows that last minute bookings by good customers have risen by 150% due to the conditions surrounding COVID-19.

30% Increase in the Average Order Value (AOV) – Forter data highlights an increase in legitimate customer spending per travel booking. This could likely be attributed to the fact that travelers are trying to book the most immediate flights or travel accommodations they can find to depart from locations that may be imminently impacted by COVID-19 travel restrictions. This rise in AOV can also be connected to the need to supply demand – with multiple travelers wanting the same tickets at the same time, it is possible for businesses to increase prices.

Fraud is expected to branch out to avenues that do not rely on reselling of goods. In other words, instead of fraudsters following more typical travel fraud MOs, fraudsters are targeting alternative areas. These include:

- Loyalty Fraud + Loyalty ATO: Loyalty fraud has increased by 89% over the last year, and shows no signs of abating. As this trend persists, it is compounded by the fact that many businesses do not have the proper precautions in place to protect this vulnerable area of the customer journey. Loyalty ATO attacks are therefore highly favored by travel fraudsters as they hack into existing accounts and steal user data, funds, benefits, and points – all while flying under the radar given limited protections in place.

- Refund Fraud: Travel businesses should be cognizant of growing instances of refund fraud occurring during this period. Fraudsters will be looking to capitalize on the huge increase in flight cancellation requests, knowing that Customer Support teams will simply not have the appropriate bandwidth to verify with a high degree of accuracy, legitimate claims from those that are fraudulent.

- “Friendly Fraud”: In cases of friendly fraud or abuse within the travel industry, it is likely that businesses will see more people filing either service chargebacks or fraud chargebacks because of their inability to travel. As long as airlines, Online Travel Agencies (OTAs), and hotels continue to cancel tickets and reimburse users, this phenomenon may be limited, but businesses should be cognizant of this potential avenue for abuse.

GROUND TRANSPORTATION

Forter data indicates that there has been an approximate 80% decrease in overall ground transportation (trains, buses, ride sharing services).

-

- Trains: Forter data indicates an approximate 80-90% decrease in rail transportation.

- Buses: Forter data indicates an approximate 90-95+% decrease in bus transportation.

In general, travelers and individuals are taking less rides and limiting the use of public transportation in order to mitigate their risk of possible exposure. Additionally, increased government guidance about sheltering in place throughout many major cities and in particular countries, has also contributed to the downward consumer buying behaviors within this industry.

Ride Sharing Services

Car rental and ride sharing services have also been greatly impacted since the time of the COVID-19 outbreak.

0% – Forter data highlights that ride sharing services have all but ceased to function. Only private rides persist – shared carpools have been stopped, limited, or paused by nearly all services.

Regional Impact – As previously mentioned, travel restrictions vary from country to country and from city to city. As such, there are some regions that are more heavily impacted in this industry than others.

Ride Sharing Fraud Trends to Watch

Typical avenues for fraud in this industry are likely to persist throughout this period. The main fraud MOs that were seen prior to the outbreak of Corona include:

- Ride Credit: Fraudsters will typically open their own accounts, procure stolen payment method (PM) details, and subsequently log into their account and add this stolen PM to their account. Fraudsters are then able to take rides as often as they like using the victim’s PM to pay their way.

- Personal Fraud: Fraud in ride sharing is typically focused on leveraging stolen payment methods and online criminals uploading credits to their personal accounts that can then be used for later use.

EVENTS & TICKETING

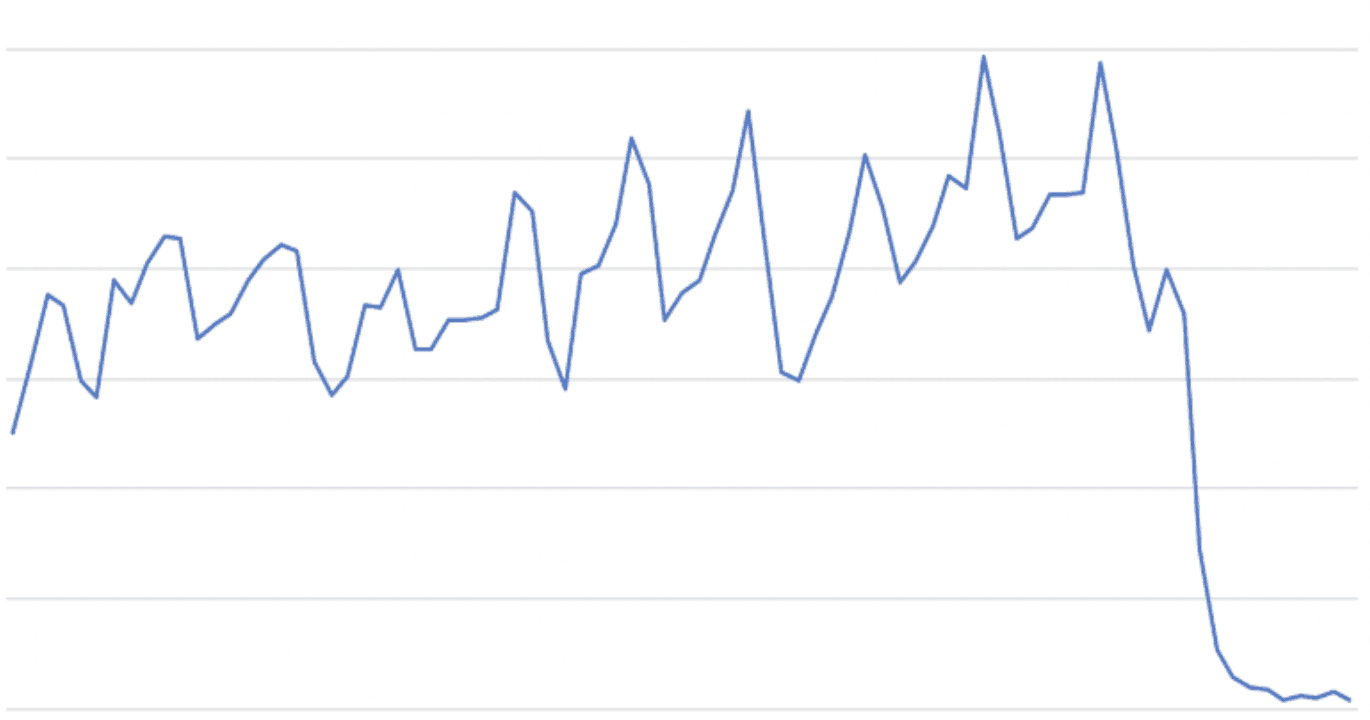

Live events and ticketing businesses have been hit hard during this time. As highlighted below, it is evident that a significant dip in overall volume of transactions at the beginning of March 2020.

As the outbreak of the virus persists, it is likely to take months before this industry is able to amply recover from this significant volume reduction. It is expected that fraud trends within this category will change and that there will likewise be an increase in service chargebacks given that individuals who have purchased tickets for events in the coming months, will not be able to attend.

The new global reality of Corona is having significant impacts on how people live their lives and how and where they choose to shop. The outbreak of the virus has underscored just how essential it is for merchants to ramp up their digital presence and transform the manner by which they do business. The shift in business approach to a more digital-first perspective not only means ensuring more seamless customer experiences – from login in, to coupon redemption, to the point of transaction, and post-purchase – but also requires more focused efforts on how best merchants can protect their online brand from fraud and abuse. In the days and weeks to come, businesses must prepare for this new reality. By partnering with a fraud prevention platform that ensures a best-in-class user experience, while assisting in elevating sales, merchants can continue to run their businesses successfully, even in the time of Corona.